Transfer of entitlements

This is an old version of the page

Date published: 5 June, 2021

Date superseded: 11 February, 2022

For recent changes to this guidance, please see the bottom of the page.

Table of Contents

- About this guidance

- Background

- Part 1 – Are you eligible to transfer your entitlements?

- Part 2 – The types of transfer

- Part 3 – When can I transfer my entitlements?

- Part 4 – The application process

- Part 5 – Who will receive the payments?

- Part 6 – Legal base

- Recent changes

- Previous versions

- Download guidance

About this guidance

This guidance provides further information about the transfer of Basic Payment Scheme payment entitlements through sale, lease or inheritance.

You must read this guidance carefully before you complete a PF23 – Application to transfer entitlements form.

RPID also has specialist units to help with queries about the transfer notification process. If you need further information after reading this guidance, please contact one of the offices below depending on where your current area office is.

Completed applications should be emailed to RPID unless there are exceptional circumstances. They should be sent from an email address registered to the seller’s business on Rural Payments & Services.

Elgin, Inverurie, Galashiels or Dumfries please email your application to:

STORNOWAY RPID Entitlement Transfer Unit

Email: sgrpid.stornoway@gov.scot

RPID

Entitlement Transfer Unit

10 Keith Street

Stornoway

HS1 2QG

Telephone: 0300 244 8501

Perth, Hamilton or Ayr please email your application to:

OBAN RPID Entitlement Transfer Unit

E-mail: sgrpid.oban@gov.scot

RPID

Entitlement Transfer Unit

Cameron House

Albany Street

Oban

PA34 4AE

Telephone: 0300 244 9340

Lerwick, Kirkwall, Thurso, Golspie, Inverness, Portree, Stornoway, Benbecula or Oban please email your application to:

BENBECULA RPID Entitlement Transfer Unit

E-mail: sgrpid.benbecula@gov.scot

RPID

Entitlement Transfer Unit

Balivanich

Isle of Benbecula

HS7 5LA

Telephone: 0300 244 9600

Please note, that the detailed guidance below does not cover the transfer of entitlements for:

- business splits

- business mergers

- whole holding transfers

A whole holding transfer is where all of the land claimed on the Single Application Form (SAF) and all the entitlements are transferred from the seller to the purchaser after the 15 May and prior to any payment for that scheme year being issued.

An example of a whole holding transfer would be where a 200 Ha farm with 150 region one entitlements and 45 region 2 entitlements is sold on 16 June 2020, the whole 200 ha and all the entitlements are transferred to the purchaser and it has been agreed that the Basic Payment for 2020 is to be paid to the purchaser.

Where businesses are to be merged or split or if you wish to complete a whole holding transfer you should contact your local RPID Area Office for advice on the process. The general procedure would be that where the notification of a merger or split is given to us prior to 15 May in any given year then we will merge or split the numbers of entitlements held by the relevant “parent” businesses in the ratio specified by the business members. There is no requirement for a PF23 in these scenarios, for a business merger you should complete a PF11 and for a business split you should complete a PF14.

Where entitlements are inherited by a member of one business from a person who was a member of a different business then this will not be dealt with as a merger. This will be treated as a transfer either with or without land (whichever is relevant), the deadline for notification of 2 [*] April applies and a PF23 is also required. We appreciate that when an estate is settled there may be issues around timing but if the legislative date cannot be met then the transfer will be processed for the following scheme year.

You cannot use a Whole Holding Transfer where a unit is sold along with entitlements after the 15 May in any scheme year and the seller is retaining the Basic Payment for the year of sale.

In this situation entitlements should be transferred using an Entitlement Transfer Application (PF23).

An example of an entitlement transfer would be where a 200 Ha farm with 150 region one entitlements and 45 region 2 entitlements is sold on 16 June 2017 and the seller is retaining the Basic Payment for 2017 and transferring the entitlements to the purchaser for the 2018 scheme year.

Background

Scottish entitlements are only tradable within Scotland: the EU Regulations governing the Basic Payment Scheme allow farmers and crofters who have established their entitlements to transfer these to others, but those receiving entitlements must be farmers within the same region.

To establish their entitlements, farmers had to submit a 2015 Single Application Form, and, where required, complete an allocation of entitlements application form, fulfilling various conditions, after which they were free to transfer, subject to other rules surrounding transfers in general.

Part 1 – Are you eligible to transfer your entitlements?

1.1 If you own Basic Payment Scheme entitlements you may be eligible to transfer them. This includes entitlements allocated to you in 2015, and those you have since been allocated, have purchased or have inherited.

1.2 You can transfer your entitlements with or without land, subject to the conditions laid down in Part 2. You can sell your entitlements, or lease them for a specific period, after which at the end of the lease we will return them to you.

1.3 The person or business that will take over your entitlements must meet the definition of a 'farmer' as determined by the European Regulations at the time of transfer. That is a natural or legal person (or a group of natural or legal persons) whose holding (production units) is situated within Scotland, and who exercises an agricultural activity.

An agricultural activity means:

- the production, rearing or growing of agricultural products, including harvesting, milking, breeding animals, and keeping animals for farming purposes

- maintaining an agricultural area in a state which makes it suitable for grazing or cultivation

or

- carrying out a minimum activity on agricultural areas naturally kept in a state suitable for grazing or cultivation. In Scotland, this is all land assigned to Payment Regions 2 and / or 3

We may ask the transferee to provide evidence of agricultural activity. This could be one or more of the following:

- census returns

- flock or herd records

- sales receipts

- veterinary evidence

Refer to the full Basic Payment Scheme guidance sections for more information on agricultural activity.

Please note: If the buyer or lessee does not meet this definition the request to transfer will be rejected.

1.4 A key part of the ‘farmer’ definition is the requirement to have an agricultural holding (production units). The minimum size of a holding is 0.3 hectares. However, to receive payment under the Basic Payment Scheme, an applicant must declare a minimum of three hectares of eligible land. Please note that we may ask for evidence to prove that the transferee is indeed a ‘farmer’ at the time of transfer.

1.5 All Basic Payment Scheme payment entitlements, including entitlements allocated from the National Reserve, are subject to a two-year usage rule.

Refer to the Main feature section of the full Basic Payment Scheme guidance regarding the usage rules.

1.6 Payment entitlements can only be used for payment by land assigned to the same payment region as them. For example, you cannot use Payment Region 1 entitlements using Basic Payment Scheme eligible land assigned to Payment Region 2.

1.7 We calculate payment entitlements to two decimal places. This means you can transfer fractions of entitlements that are no smaller than 0.01 hectares.

Usage rules

1.8 All Basic Payment Scheme payment entitlements, including entitlements allocated from the National Reserve, are subject to a two-year usage rule.

The rule has changed, compared to the two-year usage rule that was in place for the Single Farm Payment Scheme. From 2015, over any two-year period, you must activate (use) all of your Basic Payment Scheme payment entitlements in at least one year.

Therefore, it will not be possible to rotate entitlements using some in year one and the remainder in year two. If you lease your Basic Payment Scheme entitlements out, you will be relying on that farmer to ensure the two-year usage rule is met.

If leased-in Basic Payment Scheme entitlements are not activated during the rolling two-year period they will revert to the National Reserve.

For example:

In the case of a farmer who had 50 Basic Payment Scheme entitlements allocated (and activated) in 2015, who then activates 30 Basic Payment Scheme entitlements in 2016 and 50 Basic Payment Scheme entitlements in 2017, they will have activated all 50 entitlements at least once in the two-year period.

However, if they had activated only 40 entitlements in 2017, they have not activated all 50 entitlements once in the two year period and the 10 entitlements not used will be withdrawn and revert to the National Reserve.

If you have entitlements in more than one region then usage will be considered within each region allocation. Where you have entitlements within the same region which have different values then the lowest value entitlements (owned or leased-in) will revert to the National Reserve first.

You may be exempt from the two-year usage rule if you can prove that you (or your business) were subject to exceptional circumstances or a force majeure event, which prevented you from activating the entitlements for the relevant Basic Payment Scheme year.

Part 2 – The types of transfer

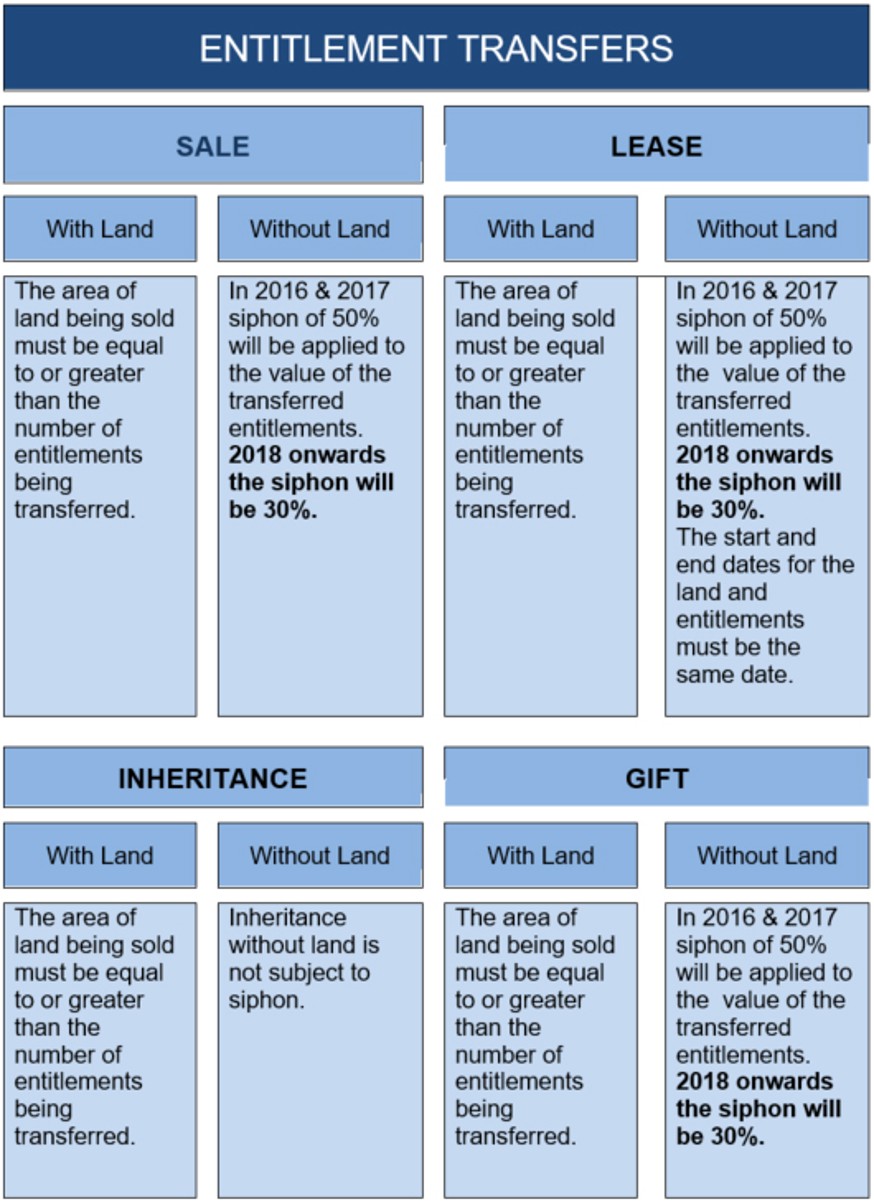

2.1 The European Regulations allow entitlements to be sold or leased; entitlements can also be transferred to another farmer as a gift, or through inheritance. All these types of transfer can be done with or without land.

2.2 If you wish to trade you can do so through a private arrangement with another farmer or between your representatives (solicitors or advisory firm). Alternatively, you can buy or sell publicly through brokers and auction marts.

2.3 If you lease with land, the start and end dates of the lease must be the same for the entitlements and land.

2.4 To apply under inheritance the executor should complete a PF23 – Application to transfer entitlements form. Supporting documents must be provided with the application (see part 4.2 for guidance on supporting documentation). Inheritance transfers without land are not subject to a siphon.

2.5 If you transfer entitlements with land you must do so with an equivalent number of eligible hectares and the land you transfer must be eligible to support a claim under the Basic Payment Scheme.

2.6 An assignation between an outgoing tenant (assignor) and incoming tenant (assignee), with the landlords consent, will be considered as a transfer with land. The documentation supporting any transfer of this type should clearly state that the transfer is assignation.

In a farming situation the assignation of a tenancy takes place where the outgoing tenant transfers his existing tenancy to a new tenant with the landlord’s agreement. In this situation there is no change to the type of tenancy and there is no break in the tenancy and this will be considered as a with land transfer no siphon will be applied.

Where the outgoing tenant gives up his tenancy to the landlord and the landlord then relets the farm to a new tenant this cannot be considered an assignation. In this situation this is a without land transfer and the siphon will be applied.

Short Term Limited Duration Tenancies (SLDT) cannot be assigned. Limited Duration Tenancies (LDT) can be assigned.

In Crofting areas the assignation of the tenancy of a croft will be approved by the Crofting Commission and in this situation no siphon will apply.

If the assignation of tenancy is not approved by the Crofting Commission it will not be accepted as an assignation and the siphon will be applied.

2.7 If you transfer entitlements without land, we will apply a siphon and will reduce the value of the entitlements transferred.

The European Regulations governing the implementation of the Basic Payment Scheme contain a provision to apply a siphon on all entitlements traded without land.

Scottish Ministers, through a public consultation, asked for views on the use of this option, the result of which now leads to a reduction to the value of the entitlements transferred by 30 per cent at the point of transfer for 2018 scheme year.

Convergence will apply to the post siphon value to ensure all payment entitlements within a region are the same value in 2019.

2.8 Note that although the value deducted will be lost to the transferee, it will go to the National Reserve and help provide additional funds for other farmers.

2.9 If the tenant owns the payment entitlements and transfers them to the landlord at the end of a seasonal let or tenancy agreement, the transfer will be considered a transfer without land and the entitlements will be subject to siphon.

Part 3 – When can I transfer my entitlements?

3.1 You can transfer your entitlements at any time but you must tell us about all transfers within the ‘notification period’. This begins on 16 May of the calendar year preceding the first year the transferee could include the entitlements in a claim for the Basic Payment Scheme, and it ends on 2 April in the first calendar year the transferee could include the entitlements in such a claim.

3.2 Help us process your application by giving us as much advance notice as you can. To allow us time to carry out administrative checks against your application, such as a validation check against our field register, please email a PF23 – Application to transfer entitlements form to your Entitlement Transfer Unit as soon as possible.

3.3 Note that if you intend to transfer your entitlements in time for the Basic Payment Scheme you must complete a PF23 – Application to transfer entitlements form and email it to the Entitlement Transfer Unit by 2 April [*].

This is because there is a ‘notification period’ set in Regulation which begins on 16 May of the calendar year preceding the first year the transferee could include the entitlements in the claim for the Basic Payment Scheme and ends on 2 April in the first calendar year the transferee could include the entitlements in such a claim. [*] When 2 April is a Saturday, Sunday, bank holiday or other public holiday, the date falls to the next working day. For 2021 this means the deadline for the Entitlement Transfer Unit to receive a transfer application is 6 April.

[*] When 2 April is a Saturday, Sunday, bank holiday or other public holiday, the date falls to the next working day.

Part 4 – The application process

4.1 Please email a fully completed PF23 – Application to transfer entitlements form to your Entitlement Transfer Unit from an email address registered to the seller’s business on Rural Payments & Services. For example the email address of either the responsible person, business member or business representatives including mandated agents / advisory firms. This MUST include all supporting documentation and confirmation of the agreement from the buyer.

4.2 You must provide confirmation of the number of entitlements being transferred and whether the transfer is with or without land together with the following information for each of the categories below:

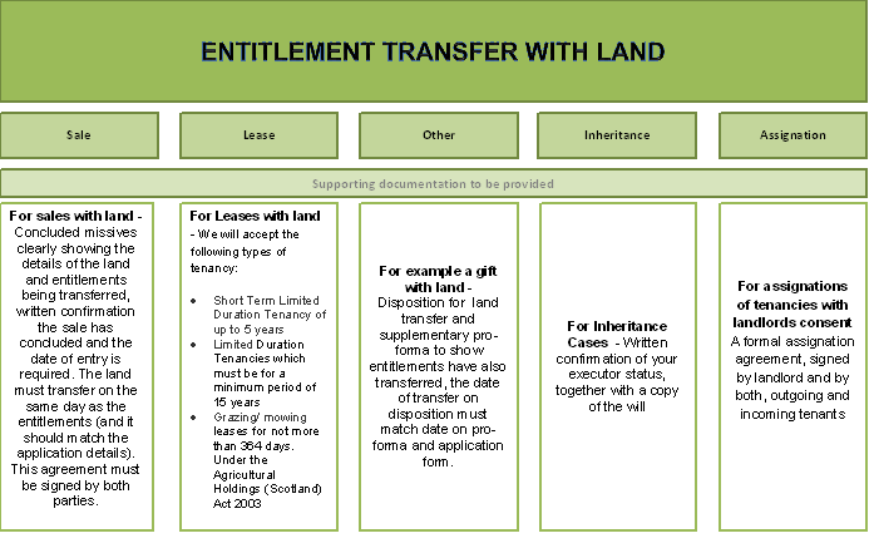

For transfers with land

Sale with land - concluded missives clearly showing the details of the land and entitlements being transferred, written confirmation the sale has concluded and the date of entry is required. The land must transfer on the same day as the entitlements (and it should match the application details). This agreement must be signed by both parties.

For Leases with land - We will accept the following types of tenancy:

- Short Term Limited Duration Tenancy of up to five years

- Limited Duration Tenancies which must be for a minimum period of 15 years

- Grazing/mowing leases for not more than 364 days. Under the Agricultural Holdings (Scotland) Act 2003

The lease must be signed by both parties, clearly showing the following:

- land (LPIDs and areas of eligible Basic Payment Scheme land)

- start and end date of the lease – this must be the same date for both entitlements and land and must match the date entered at part 3 of the application

For Crofting sub-lets with land – We will accept the following types of crofting lets:

- Approved sublet from the Crofting Commission

- Owner occupied croft short term let for a period not exceeding ten years. Approved by the Crofting Commission

The application must be accompanied by a letter from the Crofting Commission confirming the lease of the croft and/or common grazing share(s) and the lease start and end dates.

Inheritance with land – written confirmation of your executor status, together with a copy of the will.

Other with land – disposition for the land transfer, the date of transfer on the disposition must match the date on the application form.

Assignations with land – a formal assignation agreement signed by the landlord and by both, outgoing and incoming tenants clearing showing the land and entitlements being transferred.

Crofting assignations with land – confirmation letter from Crofting Commission showing the croft has transferred with the date of transfer.

For transfers without land

Inheritance without land – written confirmation of your executor status, together with a copy of the will (inheritance transfers without land are not subject to siphon)

4.3 You can make multiple transfers (for example, some entitlements with land and some entitlements without land) using the same form, as long you are transferring these to the same business. Otherwise you must use a separate form for each transfer.

Part 5 – Who will receive the payments?

5.1 We will pay on entitlements held as at 15 May. So, the effective date of transfer will determine who gets paid in any given year. For example, if you wish the transferee to receive payment, you must inform us on or before 2 April [*]. If it takes place after 2 April, any payment that is due will go to you if you have submitted a valid Single Application Form.

5.2 Note that if for any reason we have to reject your application, and you have submitted it near to 2 April (as explained above), you will not be able to submit another application in time to allow the transferee to claim for the entitlements in that year. In this scenario you will be the one responsible for the use of these entitlements in that year.

5.3 Both parties should also be aware that if after finalising a transfer we discover that the seller / lessor should not have been awarded the entitlements, we must take back the appropriate entitlements and ask both parties to repay, with interest, any monies not due to them.

5.4 Recipients of traded entitlements are still subject to scheme conditions and eligibility criteria for payment. In order to receive payment under the Basic Payment Scheme, all farmers and crofters must have eligible land at their disposal, and be engaged in a recognised agricultural activity.

Part 6 – Legal base

6.1 The trading of entitlements is permitted under Article 34 of Regulation (EU) No 1307/2013, Article 25 of Commission Delegated Regulation (EU) No 639/2014 and Commission Implementing Regulation (EU) No 641/2014. Please note that this EU legislation has now been rolled over into domestic law as ‘retained EU law’.

Recent changes

| Section | Change |

|---|---|

| About this guidance | New requirement for email submission of PF23 |

| Part four | New requirement for email submission of PF23 |

Previous versions

Download guidance

Click 'Download this page' to create a printer-friendly version of this guidance that you can save or print out.